Simple Electronic Know Your Customer Checks Quick and secure customer onboarding

Companies are required by the Know Your Customer (UK) regulations to identify and handle high-risk customers. You can rapidly authenticate your customer and identify any high-risk indicators with our KYC solution.

Know Your Customer (KYC)

Checks Online

Verifying the identification of your customers enables you to abide by Know Your Customer (KYC) regulations and guards your company from fraudulent conduct.

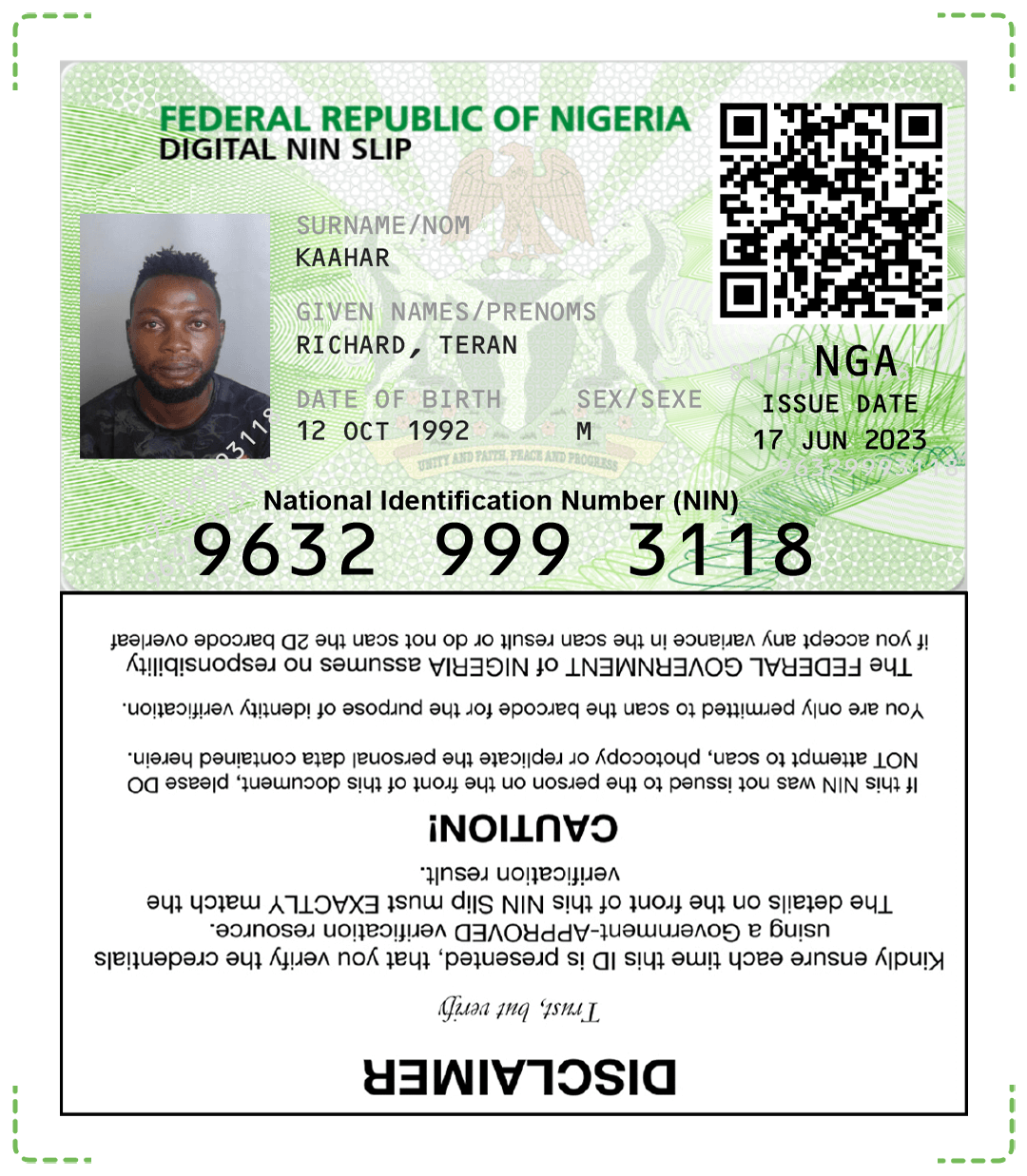

Using next-generation facial recognition technology, our ID and identity verification software was created to allow you to run ID checks in real-time and verify that the ID matches the real person. We can authenticate more than 4,000 distinct forms of identification from around the globe.

Recognize high-risk clients with ease

You may rapidly identify potentially high-risk consumers who need Enhanced Due Diligence by using our PEPs and Sanctions checks. Our technology performs searches against more than fifty distinct PEPs and sanctions lists, which are updated on a daily basis. It provides instantaneous results and establishes continuous surveillance.

Your company will receive a clear audit trail from ValidiFX along with reassurance regarding the security of your extremely sensitive data. Get Started

Important Details Of Our KYC Checks

- Remote ID Checking

- Sanctions screening and PEPs

- Proactive, continuous observation

- Business UBO audits

- Digital Address Verification Unfavorable media inquiries

What Help Can Validifx Provide?

With the use of state-of-the-art facial recognition technology, ValidiFX assists clients in performing ID checks in real-time, eliminating the need for labor-intensive, complicated, and frequently costly processes.

ValidiFX is able to do thorough background checks on people and businesses, as well as validate over 4,000 different kinds of identity documents, thanks to its partnerships with numerous top commercial data providers.

ValidiFX makes sure our clients fulfill their compliance requirements while empowering businesses to handle the challenging onboarding and personnel monitoring processes.

ID checks can be performed using a regular web browser or the market-leading ValidiFX mobile app.

Reduce staff hours by using our quick and easy Checks to Know Your Customer Get Started

Frequently asked questions

About Know Your Customer, addressed

Why do the checks matter?

Making ensuring that every aspect of the company—from distributors and consultants to clients and agents—complies with anti-money laundering and anti-bribery legislation is the primary goal of KYC checks.

It lessens the possibility that doing business with clients who have engaged in illicit money handling could damage your company's reputation in addition to shielding you from becoming a victim of fraud.

Which organizations do "know your customer" background checks?

Businesses that deal with money in one way or another, such as credit companies, insurance companies, and financial institutions, have come to favor the verification procedure.

KYC checks can be used by other companies that obtain comprehensive client data in order to thwart fraud in order to make sure they are not inadvertently supporting money laundering, corruption, or bribery.

Which KYC records are necessary?

You must get documentation confirming your customers' legal name, any name changes, accurate permanent address, and evidence of identification and proof of residence in order to do KYC checks.

In what ways does ValidiFX support "know your customer" checks?

A complicated, costly, and time-consuming step in the due diligence process for your company is frequently the KYC check.

By providing electronic identification verification software that conducts real-time ID checks utilizing two-way user face recognition technology, we at ValidiFX hope to make the process quick, simple, and safe.

Save yourself and your clients time and effort by adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) rules.

Businesses can also keep an eye on their clients' behavior to spot any suspicious or unusual activities by doing these checks.

Our Partners

.png)